Dynamic Product Ads for Fintech Apps

Here's how Finance apps can leverage Dynamic Product Ads (DPA) to automatically deliver relevant services to users based on their individual interests and behavior.

August 25, 2021

Hold up ✋, can Dynamic Product Ads (DPA) work for Fintech Apps? YES.

As our friends at Apptopia rightfully pointed out: the pandemic accelerated the digitization of money and banking with Finance apps hitting record highs for both downloads and user sessions in Q4 2020. Both established players (a.k.a traditional banks) and their new rivals (neobanks, investment apps, transactional apps, buy-now-pay-later apps) developed innovative and improved solutions to attract customers. DPA can be a great tool for marketers looking to showcase their wide range of solutions as Fintech apps keep growing in 2021.

This blog post takes a look at:

- What are Dynamic Product Ads (DPA)?

- How does DPA work?

- What are the advantages of DPA?

- What can you test with DPA?

- What are the requirements to run successful DPA campaigns?

Feel free to skip ahead to the most relevant section for you, we don’t mind!

Dynamic Product Ads for Mobile Apps

Dynamic Product Ads (DPA) use machine learning to scale your creatives when your app has a broad range of products or solutions. This ad format can automatically deliver relevant services to users based on their individual interests, intent, and in-app actions. Sounds good? It gets better 👇

Advantages of Dynamic Product Ads

- Granularity at scale: you can promote your entire suite of services (such as credit cards, loans, insurance, and investments to name a few), without the hassle of manually creating multiple creative variations.

- Creative optimization: DPAs decide in real-time what product to show to each user based on their interests and past in-app behavior, so ad content is as personalized and updated as it can possibly be.

- Automatic: powered by machine learning, DPAs are plugged directly into your product feed to automatically create multiple ad variations for each service.

How do Dynamic Product Ads Work?

Step 1: Technical setup

We connect our DPA feature to the app product feed—essentially a list of the products and services you’re looking to grow.

Step 2: User interest

We leverage in-app event data to understand the value of each user and which services they have browsed/ shown interest in to inform our optimization algorithm.

Step 3: Your ad in another app

DPA will show different ads to different users based on their specific interests. Some will see ads for cards, some for crypto trading, and others for loans or insurance, based on their previous in-app interactions.

Step 4: Deep link to your app

When users click on your ad, they are directed (via deep link) to the in-app screen of the advertised service so they can complete the desired action.

Step 5: New ad on other apps

When a user engages with that specific solution within your app, the ads are automatically turned off and complementary solutions can be shown to that user.

What can you test with DPA?

DPAs feature dynamic elements (such as image, title, description, and CTA) that can be updated in real-time or based on user interaction. Each of these elements can be used to promote specific aspects of your financial solutions.

💳 Financial products & services

Promote your entire product offering. Create a product feed with a selection of the services you’re looking to grow, and leverage DPA to automatically build ads showing the most relevant options based on users’ interests.

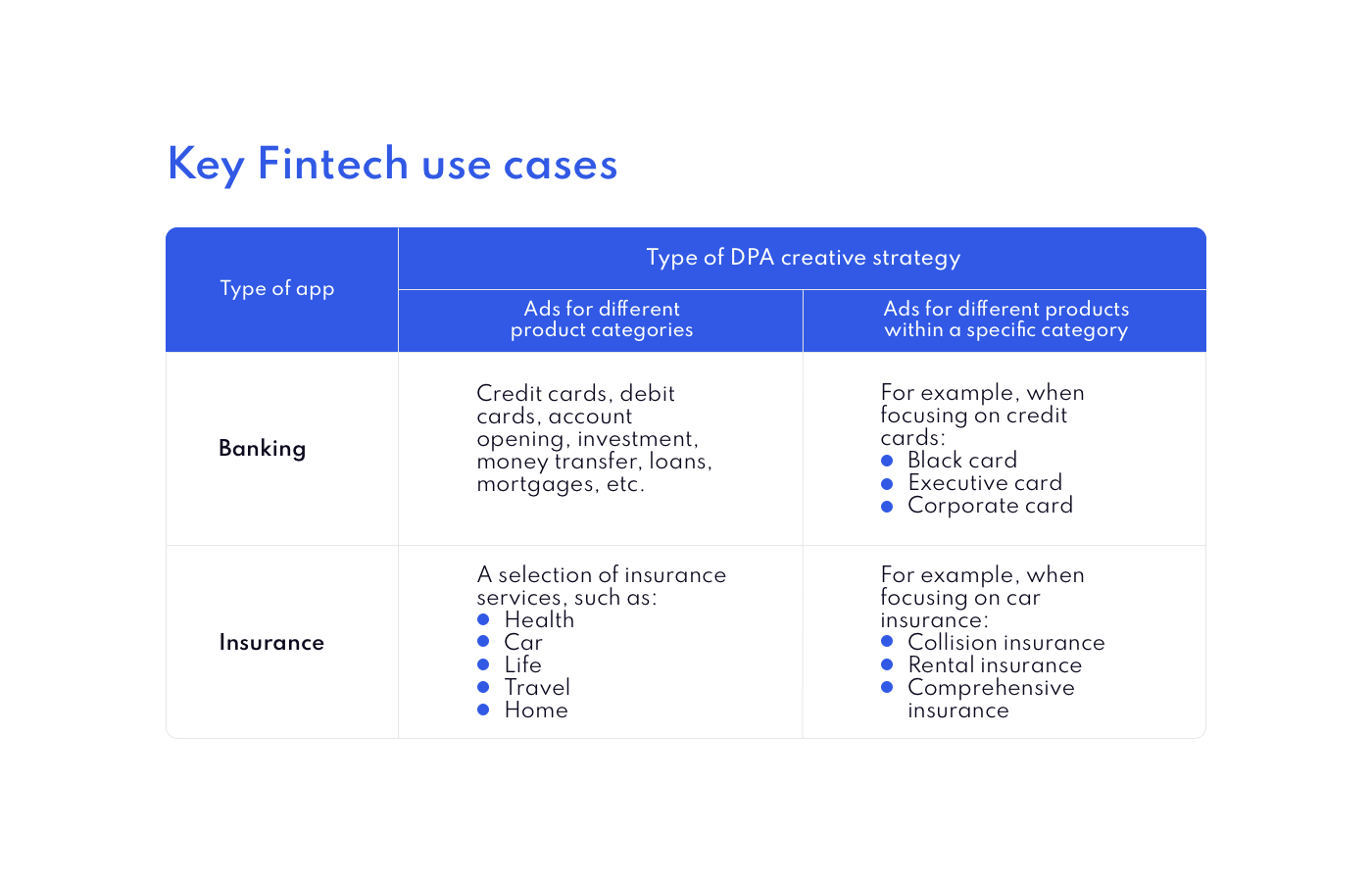

When testing different products and services, DPA enables app marketers to:

- Focus on their entire offering to build ads across all their product categories

- Focus on a specific product category to build ads showing different variations of that same product

💰 Investment and crypto values

One of the challenges of Fintech apps focused on investments or cryptocurrencies is that prices tend to fluctuate. With DPA, app marketers can show the updated value of each crypto or stock—which means users will see ads with relevant information.

Here are some of the aspects that Fintech apps should align to their unique goals when using DPAs:

- Timing: Choose when the values will be updated, whether it’s on a monthly, weekly, or daily basis—or after a specific number of hours.

- Priority: For example, an Investments app might offer opportunities across multiple stocks, but leverage DPA to show ads for the most traded stocks of the day, week, or month within a product feed.

- Interest: Serve relevant ads based on past user engagement with a specific asset, maximizing the chance for the user to trade again.

DPA requirements

- In-app event data: Analyzing event data helps us determine the value of each user and understand which products and services resonate the most with them.

- Product feed: Share your feed via link in a CSV or XML format to make the integration seamless! Make sure to include the following fields for each service: (1) Product ID, (2) Product name, (3) Product image.

- Deep links: You can internally create universal links or use your MMP’s solution, but deep links are fundamental to ensure that the hyper-relevant ads lead users to the right app screens for optimal results.

- Brand assets: We use your logo, creative guidelines, and visual assets to automatically build custom, on-brand ads.

Want to learn more?

If you want to learn more about how DPA can help you unlock incremental performance for your Fintech app, contact us to schedule a demo with one of our sales reps, or learn more about Jampp’s solutions for Financial Services.

Subscribe to our email newsletter